Introduction

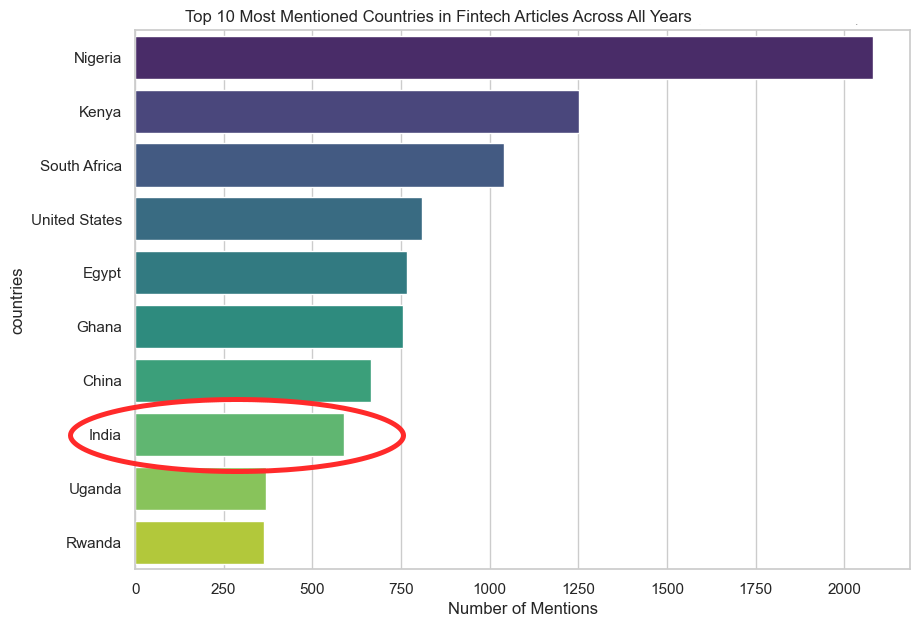

In recent years, the African fintech sector has attracted considerable interest, with nations like Nigeria, Kenya, and South Africa at the forefront of this burgeoning industry. However, an analysis of the most mentioned countries in media coverage from 2013 to 2023 reveals an often-overlooked player in this narrative: India.

This post delves into India’s increasing influence and participation in Africa’s fintech scene.

The Traditional Leaders: Nigeria, Kenya, South Africa

Nigeria, Kenya, and South Africa have been the traditional focal points in Africa’s fintech conversation. Nigeria is home for multiple Fintech startups that have positioned the country as a leader in the sector. Kenya, known for its pioneering role in mobile money, has set a benchmark for other nations. South Africa’s advanced banking and fintech sectors also place it at the forefront of this innovation drive.

Global Influences: The Role of Non-African Countries

The involvement of non-African countries like the United States and China is significant in shaping Africa’s fintech landscape. These nations contribute through investment, global partnerships, and technological collaborations. A notable example is the partnership between China’s Alipay and a Nigerian B2B fintech firm in 2019, aimed at facilitating payments between Alipay users and African merchants.

India: A Substantial Yet Underrepresented Contributor.

But, there’s an underrepresented fact that deserves the spotlight—India’s engagement with African fintech. Despite being less highlighted, India’s contributions are far from negligible.

Case in Point: Airtel Africa’s Strategic Initiatives

In 2023, Airtel Africa, part of Indian multinational Bharti Airtel, teamed up with a global payment network to revolutionize payment and remittance services in 14 African countries. This initiative targeted over 100 million Airtel subscribers, enhancing their experience with mobile wallets and streamlining transaction processes ⇲.

India’s Investment in Africa’s Digital Financial Inclusion

The Indian government committed $2 million to the Africa Digital Financial Inclusion Facility, overseen by the African Development Bank, leveraging India’s digital payment system experience to foster financial inclusion in Africa ⇲.

The Flutterwave-IndusInd Bank Partnership

A case of India’s involvement is the collaboration between African payments startup Flutterwave and IndusInd Bank, a leading Indian financial institution. This partnership focuses on enhancing remittance services between India and Africa ⇲.

Conclusion

India’s rising role in Africa’s fintech sector is a narrative that demands greater attention. This trend, characterized by strategic partnerships, investments, and collaborative initiatives, highlights the significance of South-South cooperation in the global economy.